Why is it a smart idea to invest in debt funds now?

Most retail investors keep their savings primarily in traditional fixed income investments like Bank Fixed Deposits, Government Small Savings Schemes etc. With the RBI hiking repo rates to 6.25%, the interest rates of Bank FDs and Government Small Savings Schemes have also gone up. However, investors may get higher and more tax efficient returns by investing in debt mutual funds in the current interest rate environment.

Why debt funds have the potential to give higher returns?

Let us compare a bank FD with a corporate bond. Suppose a 5 year Bank FD is giving 7% interest rate per annum. A company issuing a 5 year NCD, will have to pay higher interest rate or coupon compared to Bank FD. If the company does not pay higher interest rate than bank FD, why will you invest in the NCD? The issuer is paying you higher interest rate because you are taking the risk.

In general, the interest rate of a risk free investment will be only slightly higher than the inflation rate. A market linked investment e.g. debt mutual fund will usually give higher returns than a fixed interest scheme which gives assured returns. However, there are some risks in debt funds which you should be aware of; we will discuss the risks later in this post.

Bond yields are attractive now

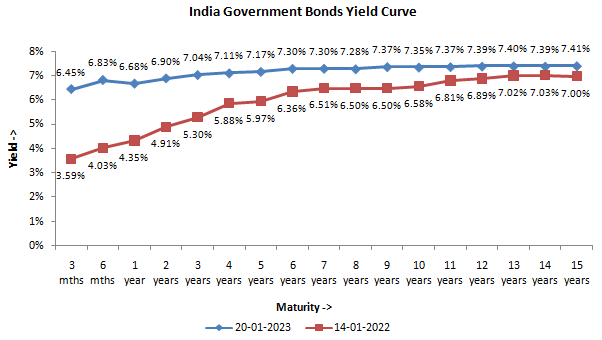

The chart below shows the yields of Government Securities (G-Secs) of different maturities. You can see that yields in the 3 year to 10 year maturities are in the range of 7 – 7.4%. This is more attractive than interest rates of bank FDs of similar tenures. Debt and money market instruments like Non-convertible Debentures (NCDs), Corporate Bonds, Commercial Papers (CPs), Certificates of Deposits (CDs) etc. give higher yields than G-Secs due to credit spreads. Credit spreads can range from 20 to 50 bps for AAA (highest credit rating) rated papers (source: CRISIL, as on 31st December 2022). Credit spreads for AA and lower rated papers are higher. You can get these yields by investing in debt funds.

Source: worldgovernmentbonds.com, Advisorkhoj research, as on 20th January 2023. Disclaimer: Past performance may or may not be sustained in the future. The above chart is purely for investor awareness purposes and should not construed as investment recommendations

Why this is a good time to invest in debt funds?

Let us first discuss the risks in debt funds. There are two risks in debt funds – interest rate risk and credit risk. We will focus on interest rate risk here.

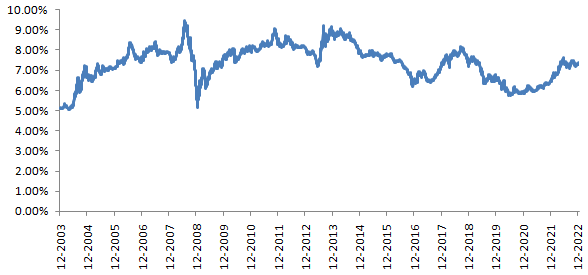

Bond prices are inversely related to interest rates; prices go down when interest rates increase and vice versa. Last 2 years have been challenging for debt fund investors since yields had been rising. Now the 10 year bond yield is around 7.4%. The chart below shows the 10 year G-Sec historical yields over the last 20 years. You can see that bond yields spiked over 8% only 3 times in last 20 years, 2008, 2011, 2013 and 2018. These spikes were mostly related to US data primarily, high inflation and GDP growth.

Source: investing.com, Advisorkhoj research, as on 20th January 2023. Disclaimer: Past performance may or may not be sustained in the future. The above chart is purely for investor awareness purposes and should not construed as investment recommendations

Let us now consider today’s situation. Inflation has been very high for last 2 years and is now showing signs of cooling, though still at high levels. Europe is already in recession. The US economy is slowing down and economists are predicting high probability of recession in 2023.In these economic conditions, chances of fed rate hikes beyond 5 – 5.25% forecast is slim because it may aggravate the economic slowdown in the US. The market has already priced fed funds rate hitting 5 – 5.25% in bond yields. Historically, 10 year yields in 7.4 – 7.5% levels have been attractive (see the chart above), except during the 2008 – 11 period. Yields have usually come down from these levels.

Long term investors can lock-in the yields by investing in debt mutual funds. If yields come down in the latter part of 2023 or 2024, investors can also get the benefit of capital appreciation.

Credit quality is very important

We have discussed about interest rate risk in the previous section. Another risk, which debt investors should always take into consideration, is credit risk. Credit risk of fixed income instruments refers to the issuers’ failure of meeting their interest and / or principal payment obligations, exposing the investor to potential loss of income and / or capital. If the issuer defaults on interest and principal payments then the price of the instrument will be written down permanently and the investor may have to suffer a loss. We are seeing signs of global economic slowdown and the risk of major developed economies going into recession is high. Economic slowdown or recession in US and Europe will impact trade, exports and will cause headwinds in India also.

Historical data shows that credit risks increase during economic slowdown. If credit risks increase spreads will widen and yields of lower rated papers will go up, impacting the Net Asset Values (NAVs) of funds which have a significant portion of their assets in AA or lower rated papers; there may be risk of default also. As such, in these economic conditions, it will be prudent for investors to select funds of high credit quality – primarily Sovereign (G-Secs, SDLs etc) or AAA rated papers.

Tax advantage of debt funds

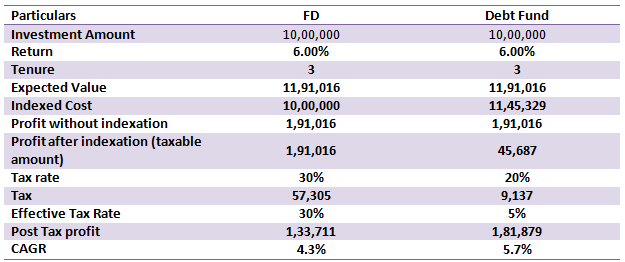

Interest income from several traditional products e.g. bank FDs are taxed as per the income tax rate of the investor. While capital gains from debt funds held for less than 3 years are taxed as per the income tax rate of the investor, capital gains from investments held for more than 3 years are taxed at 20% after allowing for indexation benefits. For investment tenures of 3 years or more, debt funds are much more tax efficient than most traditional fixed income investment options e.g. bank FDs.

The table below demonstrates how conservative hybrid funds are much more tax efficient than traditional fixed income schemes like Bank FDs for investors in the higher tax brackets. In this example, we have assumed that Cost Inflation Index (CII) in the year of purchase was 289 and CII in the year of redemption is 331.

Disclaimer: The above illustration is purely for investor education purposes. You should discuss the tax consequences of your investment with your tax advisor.

How to invest in debt funds?

Debt funds offer solutions for different types of risk appetites and investment tenures. You can see that yields are high across all the maturities in the yield curve. You should select funds based on your investment tenure and risk appetite.

- For investment tenures of up to 1 year, debt funds investing primarily in money market funds are suitable e.g. liquid funds, ultra short duration funds, money market funds and low duration funds.

- For 2 – 3 years investment tenures short duration funds, corporate bond funds, banking and PSU funds etc. are suitable investment options. Investors who are willing to take credit risks can get higher yields from credit risk fund. You should invest according to your risk appetite.

- For 3 years plus investment tenures, long duration funds, constant duration funds, target maturity funds etc. are suitable investment options. You should invest according to your investment needs and risk appetites.

Investors should take the advice of their financial advisors or mutual fund distributors about the suitability of different debt mutual fund products for their specific investment needs and risk appetite.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Source : www.advisorkhoj.com

Comments

Post a Comment